Millions of homes will face a hike in their council tax bills from April onwards as the UK economy continues to falter.

According to the County Councils Network (CCN), three-quarters of English councils with social care duties are going to increase council tax by 5%.

Advertisement

That’s the most each council can increase it by without taking a local vote from residents.

Out of the 114 councils who offer social care and have published their 2023/24 budget proposals, 84 are planning to go with the maximum hike – that’s almost three in every four.

Only Central Bedfordshire council plans to keep tax at its current rate.

The remaining councils are still yet to reveal their plans, although Croydon, Thurrock and Slough have permission to go above the 5% threshold because they are particularly low on funds.

Here’s what you need to know.

What is council tax?

It’s a compulsory charge on all properties in England, Scotland and Wales, which is the main source of income for most councils.

Local authorities decide how much residents need to pay based on how much they want to spend on the services in their area.

Advertisement

These services include rubbish collection, libraries, police and fire services, snd libraries.

It also fluctuates according to each home’s value. They are all graded into different bands at a certain time, with more expensive properties being higher grades. Find out what your property’s is here, on the government website.

The average property in England – which will have been valued on April 1, 1991 – is and D. The yearly council tax for that is £1,966.

Scottish councils can set their own rates with complete independence, while in Wales, the government can cap the council tax rises if they are seen to be “excessive”.

Councils also receive some funding from business rates, and central government grants.

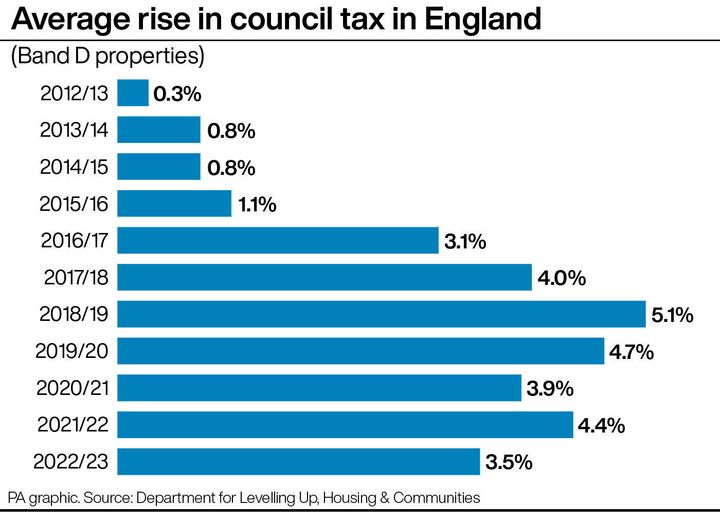

PA Graphics via PA Graphics/Press Association Images

Who pays council tax?

Almost everyone over 18 who owns or rents a home has to pay council tax – that means tenants, not the landlords, are responsible for footing this bill.

Advertisement

If you live alone you can get a 25% discount, and student homes are exempt, as are those living in halls or residence or care home.

If you work away from home and your property is empty you can get it half price.

Why is the bill going up?

The UK already has the highest tax burden in 70 years.

The government has also agreed to let local authorities spend an extra £5.1 billion next year (that’s a 9% rise for local authorities), with the most deprived areas of England set to receive 17% more per household this year than the least deprived.

But, council leaders say they have “little choice” but to raise the tax to protect the services offered to residents.

Labour vice-chair of CCN, leader of Cheshire East Council, Sam Corcoran, said: “With inflation reaching levels not seen for over 40 years and with demand-led pressures for care services showing no sign of abating, local authority leaders are setting their budgets in the most difficult circumstances in decades.”

He said that while the cost of living crisis is affecting every household, particularly those on low incomes, many local authorities are “reluctantly opting for maximum rises”.

Advertisement

“With councils facing multi-million funding deficits next year, the alternative to council tax rises would be drastic cuts to frontline services at a time when people at the sharp end of the cost of living crisis need us to be there for them.

“With the financial situation for councils looking extremely tough for the next few years, we will be calling on the chancellor for further help in the March budget.”

The Office for Budget Responsibility (OBR) says this will raise £3.3billion in 2026/27, and will increase to £4.8billion in 2027/28.

What does this mean for your bills, in real terms?

It would add £98 a year to bills for the average Band D properties.

Band D properties in England already pay £1,966 per year – so from April, this will probably be around £2,064.30.

The council tax amount varies from property to property. To find out how yours might change, calculate 5% of your annual rate (find it here) and then add it on to your current bill.

Advertisement

What does the government say?

The government made it possible to increase the council tax levy by 5% without a vote last autumn.

Before that decision from chancellor Jeremy Hunt, local authorities needed to hold a referendum to raise the levy by more than 3%.

The government also seems to have encouraged councils to apply this money pressure to residents.

A Levelling Up department spokesperson said: “Our approach to council tax balances the need to deliver vital services while protecting residents from excessive increases.

“We expect local authorities to take into consideration the challenges many households are facing.”

Levelling up minister Lee Rowley is also reviewing the council tax system, after complaints about different amounts being raised in different parts of the country.