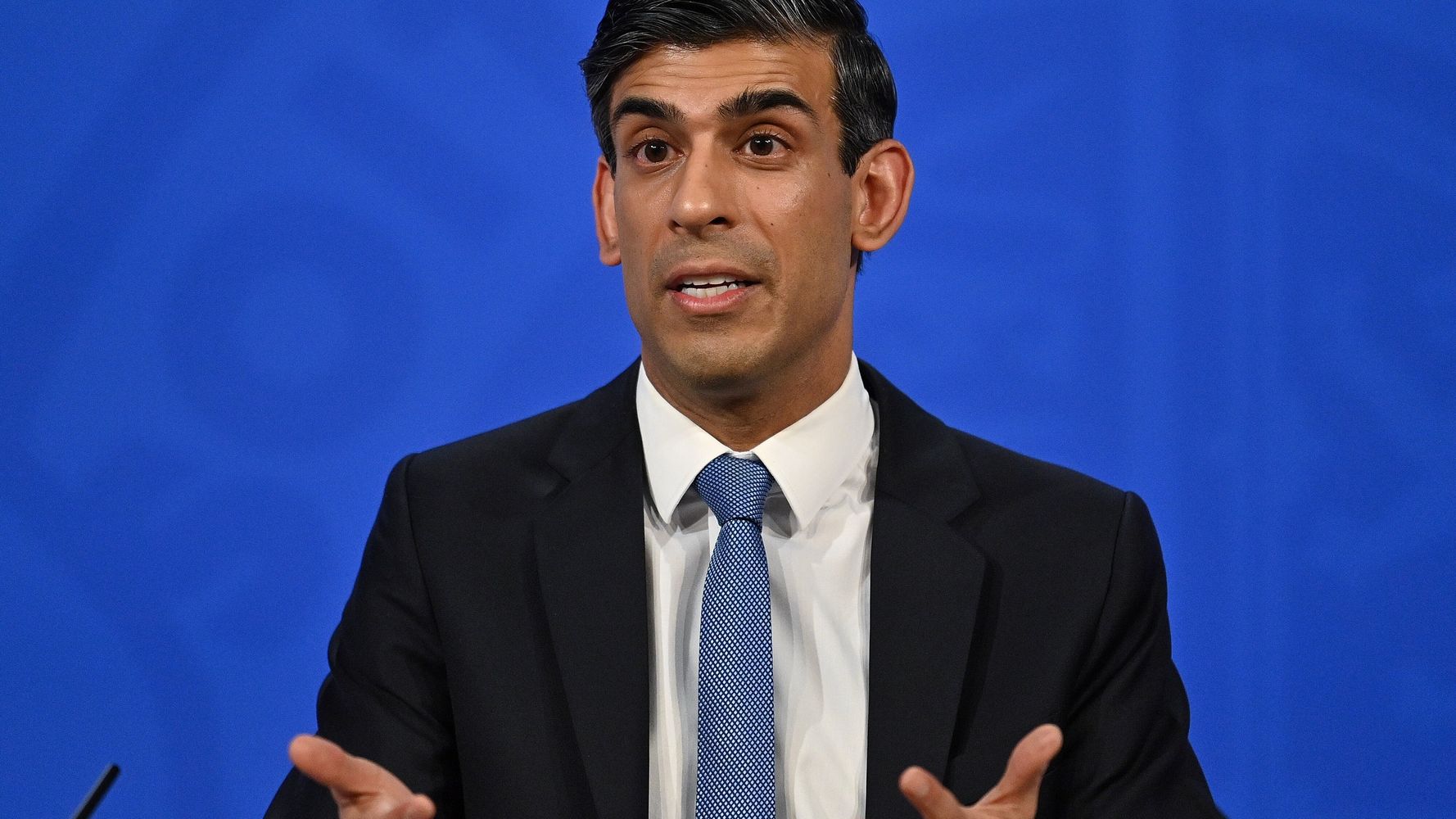

Brexit is largely to blame for UK exports lagging behind other countries, Rishi Sunak has admitted.

The chancellor was responding to data showing the amount of goods British companies are selling abroad has fallen since 2019 when compared to other advanced economies.

Advertisement

Asked about the worrying trend while appearing in front of the Treasury select committee, Sunak said it was “always inevitable that if you change the exact nature of your trading relationship with the EU, that was going to have an impact on trade flows”.

Committee chairman Mel Stride asked the chancellor whether he was concerned the UK was becoming “more of a closed economy post-Brexit”.

Advertisement

He added: “Why have we got the significant reduction in trade intensity that’s stayed low whereas other have come back?”

Sunak, who backed Brexit in the 2016 referendum, said: “Without a doubt we’re changing our trading relationship with the EU and that means a different set of controls and things that people will have to do and that will obviously have an impact and that, I’m sure, is a big part of the reason why this is happening.”

Advertisement

He added: “The benefit of new trading relationships take time, they don’t happen all overnight.”

Earlier, the chancellor had been forced to defend his widely-criticised spring statement, which failed to provide any extra help for those on benefits.

He said it would have been “irresponsible” for the government to have borrowed more to increase the welfare bill in the face of rising inflation.

Mel Stride said the chancellor had done “very little” for those who were out of work and relying on benefits.

Advertisement

But Sunak said: “If someone’s view is government can or should make everybody whole for inflation – particularly inflation at these levels caused by global supply factors – then that’s something that I don’t think is doable.”

He said that raising benefits by the current rate of inflation – which is forecast to rise to more than eight per cent – rather than what it was last September, would have added £25 billion to Government borrowing in the period up to 2026-27.

He said that “irresponsible” borrowing levels risked stoking inflation even further, adding to the pressure on living standards.

“We are already forecast to borrow in this coming year about 60% more as a percentage of GDP than our post-war average, 20% more as a percentage of GDP than we were forecast to borrow in October, so it is already a significant amount of borrowing,” he said.

“My view is an excessive amount of borrowing now is not the responsible thing to do.”

Sunak said his decision to announce he intended to cut the basic rate of income tax by a penny from 2024 would inject “discipline” into the debate about public spending levels.

“Now having something to aim for means that hopefully we can have a more disciplined conversation about incremental public spending at this point, which is already at very high levels,” he said.

“My priority at this point forward is to keep cutting taxes, not increased public spending.”