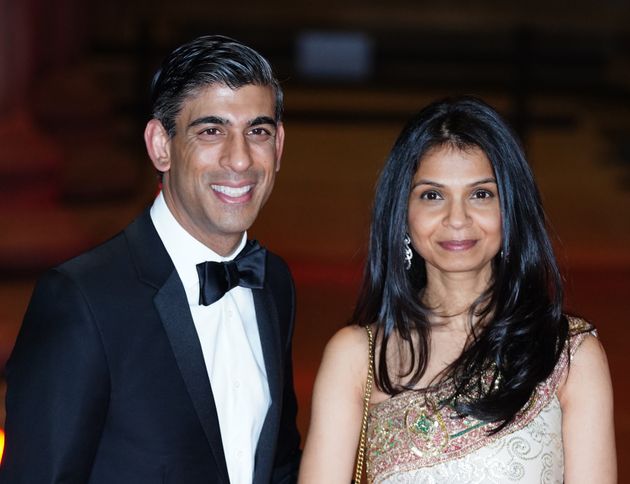

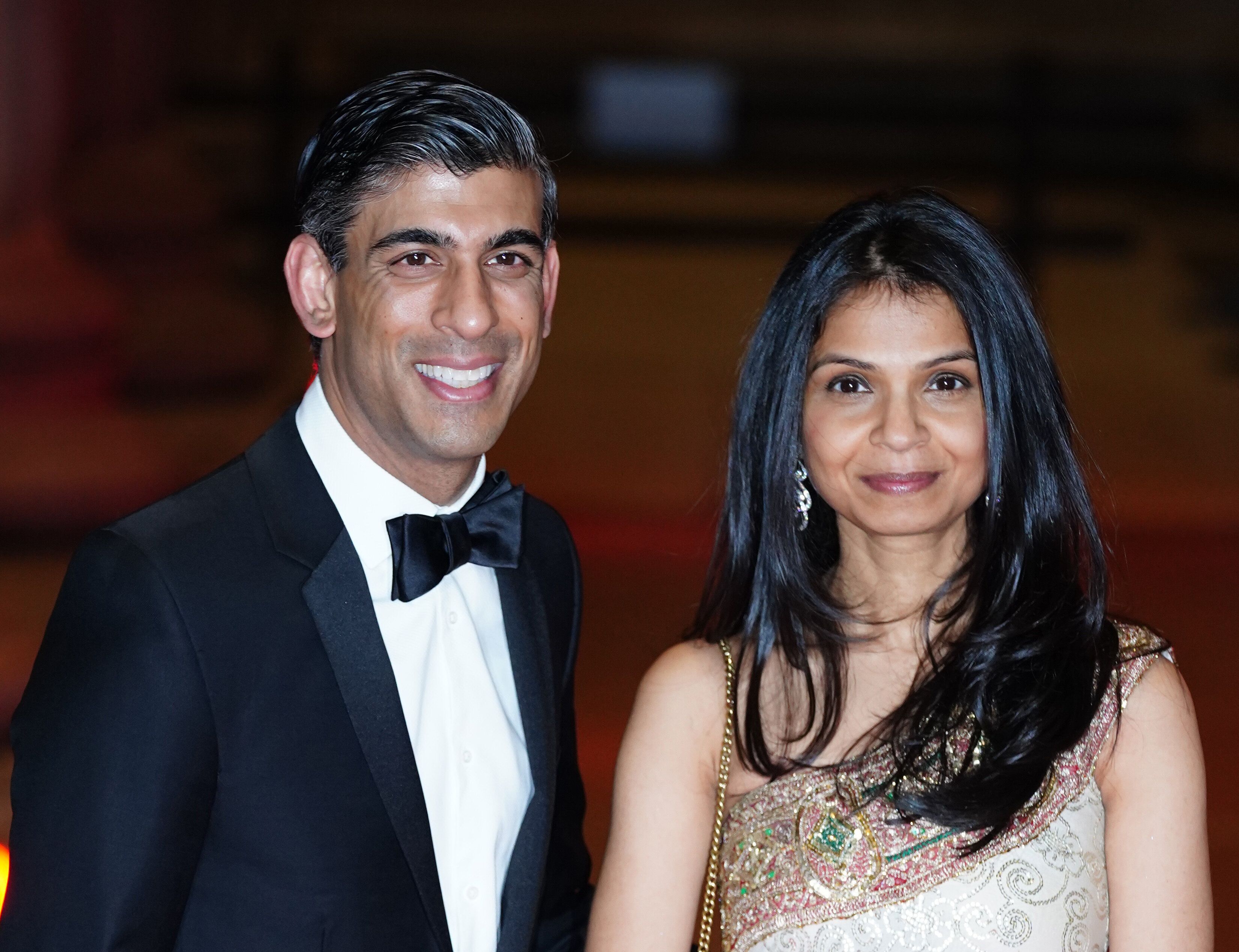

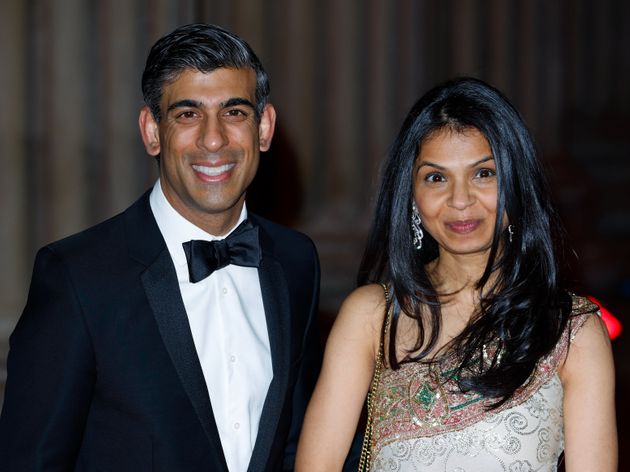

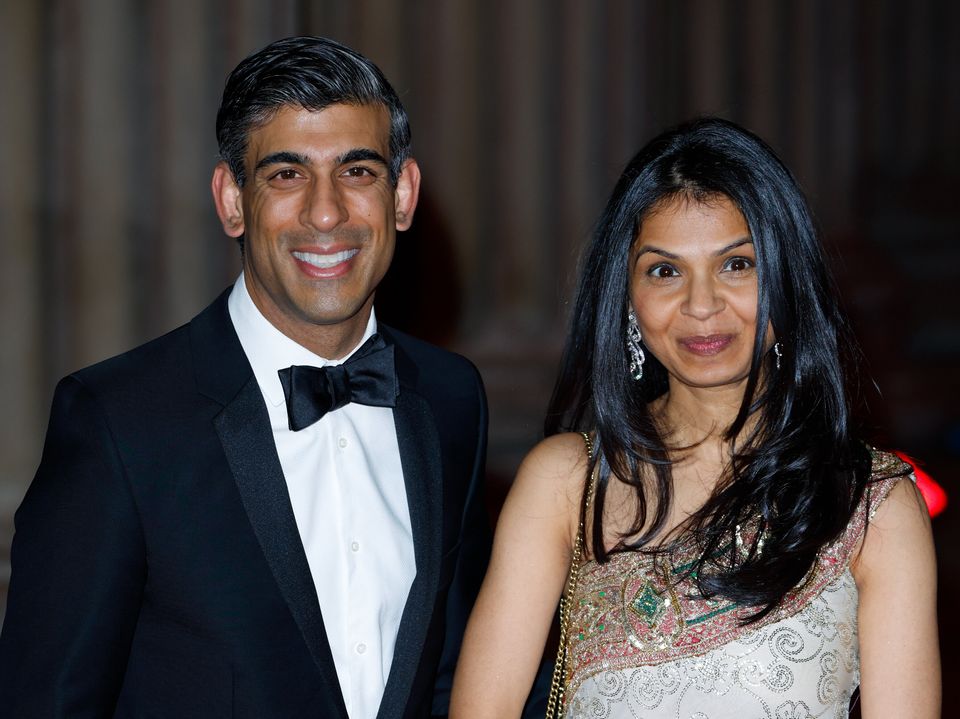

If Rishi Sunak had any doubts that the shine has gone off his reputation among Tory MPs, the last few weeks will have removed them entirely.

Once seen as Boris Johnson’s heir apparent, the chancellor saw his popularity nosedive recently over an underwhelming Spring Statement and revelations about his wife’s tax affairs.

Advertisement

HuffPost UK has learned that Sunak has been meeting with groups of Conservative backbenchers to get their views on how he should tackle the cost of living crisis, and they have not been holding back.

“He’s not the golden boy any more,” said an MP who attended one of those gatherings last Monday night. “There were around 30 of us and we gave him a hard time.”

Advertisement

Sunak’s answers to their forceful questions failed to assuage their anger.

“He came across as making excuses for the state of the economy,” one former cabinet minister told HuffPost UK. “The most wounding criticism was that it isn’t clear what the government’s economic policy is.

Advertisement

“Some people brought up the fact that at least David Cameron and George Osborne had their ‘long-term economic plan’ and it was consistent. If tough decisions had to be made, they were made in that context.

“What is this government’s economic policy? No one has any idea.”

This uncertainty is typified by the chancellor’s will-he-won’t-he approach to a windfall tax on the enormous profits currently being enjoyed by oil and gas companies.

Thanks to the global spike in energy prices, the likes of BP and Shell have posted astronomical earnings, leading to Labour and the Lib Dems calling for a one-off levy, with the money raised going towards cutting household bills.

Advertisement

The government’s response has been to criticise a windfall tax in principle, while being careful not to rule out bringing one in. This led to Tory MPs being forced to vote en masse against a windfall tax earlier this week, fully aware that the government may well end up backing the policy within days.

The confusion at the heart of government has even led to reports that two of the prime minister’s key advisers are making clear their opposition to a windfall tax at the same time as the Treasury appears to be laying the groundwork for one.

“We are all exploring every option available to grow the economy and ease the cost of living,” a senior Number 10 source told HuffPost UK. “It’s not the case of one lot advocating and another blocking.

“It’s just good government – testing the arguments, exploring the merits, getting the detail right and setting the bar high for doing something no Conservative instinctively wants to do.”

One former Conservative frontbencher said he had some sympathy for the chancellor.

“The problem for Rishi is that Tory MPs are all over the place on what they want done,” he said. “There’s not a consensus other than something needs to be done, and that makes his position very difficult.

“There are people who want a windfall tax and there are people that don’t want a windfall tax. Others want to see benefits uprated and others who want tax cuts.”

Asked what he thought Sunak would opt for, the MP said: “There’s going to be a windfall tax, that seems clear. But in the usual way, Tory MPs were marched up the hill to vote against it.”

UK Parliament/Jessica Taylor via PA Media

Another Conservative MP said he would reluctantly support a windfall tax, given the extent of the crisis facing household budgets.

He said: “The current situation doesn’t feel sustainable. The oil and gas companies are making enormous profits out of events that are completely out of their control. How can we be the only people defending them?

Advertisement

“If you look at what happened in the 90s, Labour went into the 1997 election promising to bring in a windfall tax and they won a landslide. If we do it, we instantly shoot Labour’s fox.

“You obviously can’t keep doing windfall taxes because they really do deter investment and harm business confidence, but there is a case for one now.

“If you look at our economic prospects, October looks horrific when the energy price cap goes up, and £150 council tax rebates just aren’t going to touch the sides.

“Government can’t solve every problem, but this is about protecting people from the worst of the cost of living crisis. I really think a windfall tax is going to happen.”

Another ex-minister said: “My sense from my conversations with colleagues is that while in principal they are against a windfall tax for exceptionally good reasons, the current circumstances, in which the energy companies are making massive profits, means the chancellor will probably go for one. He’s getting strong briefing that we should have one from the Treasury.”

But the MP warned the chancellor that the parliamentary party wants to see the tax burden – which is now the highest it’s been for 70 years – fall as quickly as possible.

“Tory MPs are getting fed up of being a high spend, big state party,” he said. “The definite sense of MPs and donors is that people are sick to death of not being a Conservative Party.”

On Wednesday night, Sunak told business leaders that he would use his next Budget in the autumn to cut their taxes, but he was silent on what immediate help he will provide for voters seeing their energy and food bills soaring.

The Treasury points to the £9bn-worth of support the chancellor announced in February to bring down council tax and fuel costs, while insisting that further support will come in October when the energy price cap is set to rise significantly once again.

But with two key by-elections coming in June, and Labour maintaining a consistent lead in the polls, Tory MPs are demanding action long before then. The big question now is what form that will take.

Advertisement

A Labour source said: “The cost of living crisis has drawn back the tide on an out of touch, dilettante chancellor.

“But Rishi Sunak is really just a symptom of the wider Tory malaise. This is a government out of ideas and rapidly running out of road – and after a decade of failing to grow the economy, all they’ve got left to offer is tax rise after tax rise on working people.”