As the cost of living crisis hits the UK hard, there’s been a lot of focus on hard-up families struggling to pay bills, feed children and make ends meet.

But let’s not forget that the crisis is biting single people, too.

Advertisement

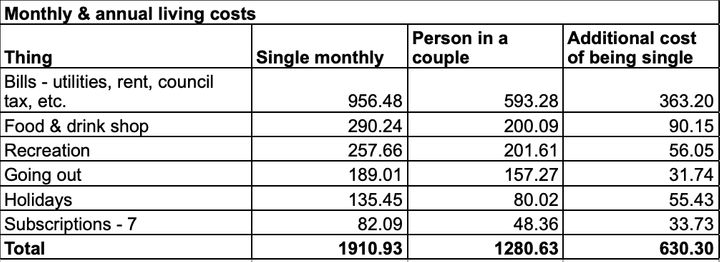

Single people on average are paying £7,564.50 a year more than their coupled-up counterparts on basic household outgoings, according to new analysis – a worrying situation considering living costs are only set to rise in 2022.

Ocean Finance has compared the typical monthly costs for single and coupled-up Brits including utility bills, rent and the monthly food shop, using data from the Office for National Statistics (ONS).

Advertisement

The analysis showed that household monthly bills are £363 more expensive for singles, with rent the biggest contributor.

A single person is paying, on average, £674 a month on rent in the UK and a couple only slightly more at £866 (or £433 per person). There is also a council tax gap – even factoring in the 25% single-person household discount, individuals with partners are paying considerably less than single friends.

Advertisement

This all adds up – with single Brits are paying an average of £630.30 more per month on outgoings than someone in a couple. The ONS estimates there are 7.9 million single-person households in the UK, meaning many are affected.

“The fact is, it is expensive to be single,” Nicola Slawson, founder of The Single Supplement newsletter, tells HuffPost UK.

“It is a totally overlooked problem that many people in relationships simply do not appreciate – and those in power certainly doesn’t seem to care.

Ocean Finance

Not being able to share your financial burden with somebody impacts all areas, says Slawson – from household bills, rent, council tax and insurance to the cost of furniture, white goods, and even the weekly food shop. “Most items come in sizes suitable for couples or families. For example, a ready meal designed for two works out cheaper than those made for one person,” she points out.

Advertisement

In turn, these expenses impact a single person’s ability to save for a mortgage and get on the property ladder, something she hears from her readers.

“There are increasing numbers of single people stuck in house shares even though they would love a place of their own but they simply can’t afford it.”

With the cost of living going up this year, the pressure on single people is only likely to worsen, Slawson worries. Take the issue of rising utility bills.

“If they live alone they have no-one to share the bills with and if they live in house shares, they don’t have total control over when things like the heating gets put on,” she says. “I know members of my community are feeling really anxious and are trying to work out where they can cut back but it’s hard.”

There is no shortage of advice being dished out on how to cut costs – partner with a friend, switch to a different tariff, even buy in bulk – but though usually well-intentioned, these tips don’t always help people, says Slawson.

“All the advice will say cancel Netlfix and go out less – but single people who live alone particularly need those things as they don’t have anyone to talk to at home.” But That respite comes at a price – Ocean Finance found single people pay £33 extra per month for multiple subscriptions to stream film and music.

Worse is the suggestion that single people should just go out and get a partner to ease the burden. “It’s not as easy as simply getting into a relationship,” says Slawson. “Many single people are actively looking for a relationship but struggling with dating apps and the sometimes toxic culture around dating.”

And she voices a final worry. “I think it’s also likely that it puts those in unhappy or abusive relationships off leaving because they are worried they simply won’t be able to afford to live alone.”